Insurance scam calls India are no longer clumsy or obvious. In 2026, fraudsters sound professional, know partial details, and exploit recent changes in calling rules to appear legitimate. Many victims don’t realize they were scammed until money is gone or a policy issue surfaces weeks later. The danger isn’t ignorance—it’s false confidence.

Understanding how these scams have evolved is the only reliable defense.

Why Insurance Scam Calls Feel More “Genuine” Now

Scammers adapted faster than most customers.

What changed:

-

Better caller ID spoofing

-

Scripted, trained callers

-

Use of real insurer terminology

-

Exploiting recent rule changes

Modern insurance scam calls India succeed because they mimic process, not urgency.

Old scams asked for OTPs directly. New ones don’t.

Common flow:

-

Caller claims policy update or refund

-

Shares partial policy or KYC info to build trust

-

Redirects you to “verification” steps

-

Pushes you to initiate actions yourself

Victims feel in control—which lowers suspicion.

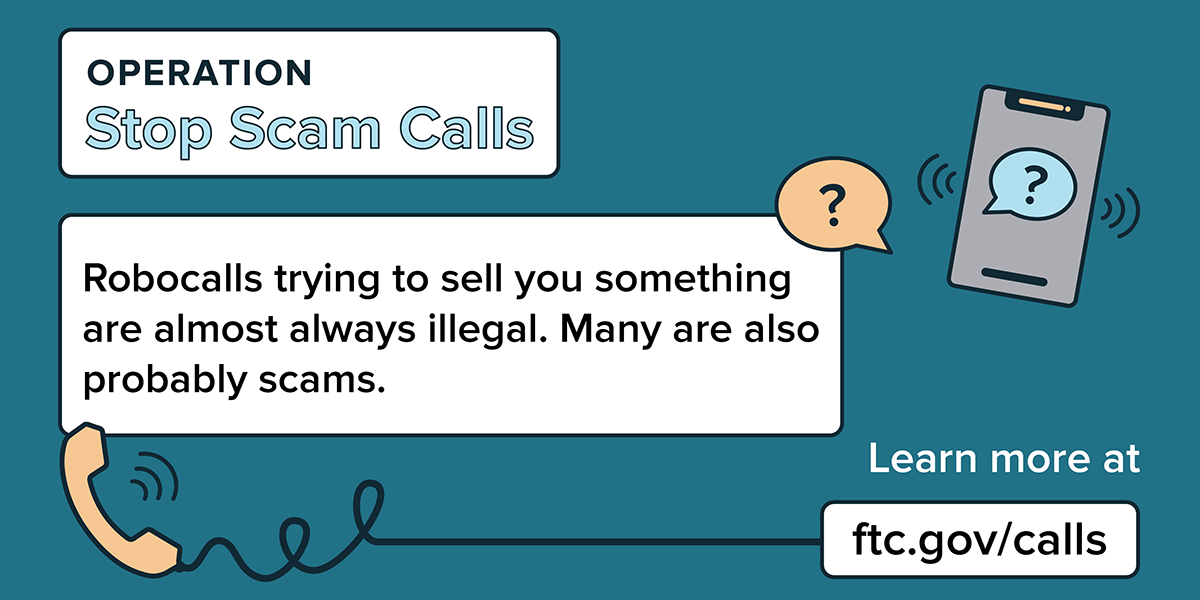

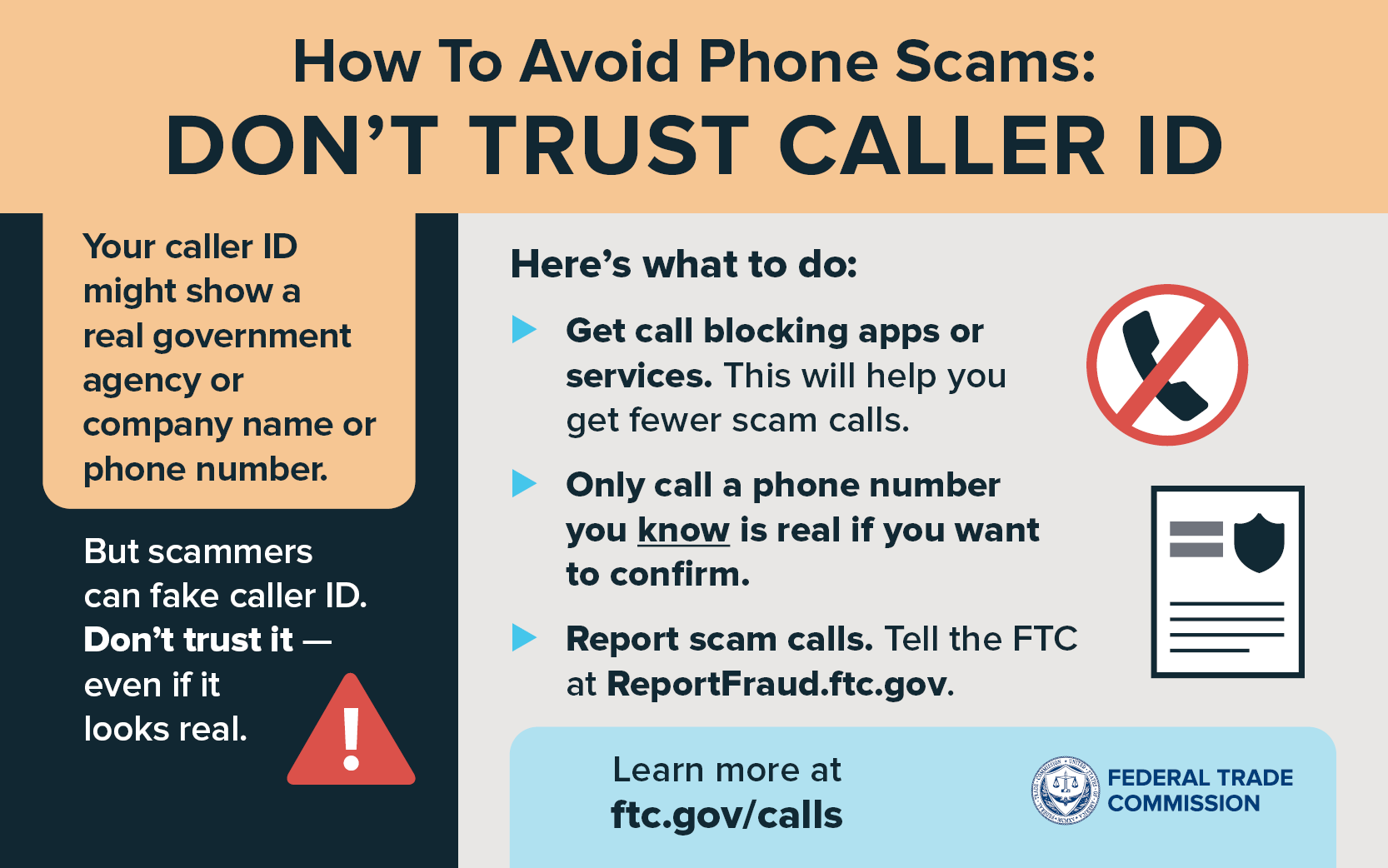

How Spoofing Makes Fake Calls Look Official

Caller ID is no longer proof.

Spoofing allows:

-

Display of official-looking numbers

-

Local STD codes matching insurer offices

-

Consistent callback numbers

Never trust identity based on number alone. Spoofing defeats that assumption.

Why “Verification” Is the Trap

Scammers avoid asking for OTPs outright.

Instead, they ask you to:

-

Confirm details verbally

-

Click links for document verification

-

Install “support” apps

-

Log in while they “guide” you

This shifts blame and bypasses alert instincts.

The Role of Partial Data Leaks

Scammers often know:

-

Your insurer name

-

Policy type

-

Approximate premium

This data comes from breaches, resold databases, or guesswork. It’s enough to sound convincing—but not enough to be legitimate.

What Genuine Insurance Calls Will NOT Do

Real insurers follow strict limits.

They will NOT:

-

Ask for OTPs or PINs

-

Request remote access

-

Push urgent fund transfers

-

Ask you to “reverse” transactions

Any of these = walk away.

How New Calling Rules Changed Scam Behavior

With verified calling systems expanding, scammers:

-

Mimic “verified” language

-

Claim backend system changes

-

Use compliance jargon

This confuses customers who assume verification equals safety.

A Simple Verification Rule That Always Works

One rule beats all scripts:

-

Hang up. Call back using the official website/app number.

Real agents welcome this. Scammers vanish.

What To Do If You Engaged With a Suspicious Call

Act fast, not quietly.

Steps:

-

Stop interaction immediately

-

Change passwords and PINs

-

Inform your insurer officially

-

Monitor bank and policy activity

Speed limits damage.

Why Educated Users Still Get Scammed

Confidence is exploitable.

Scams work because:

-

Calls sound procedural

-

Victims feel “smart” complying

-

No obvious red flags appear

This is a psychology problem, not an intelligence one.

How Customer Awareness Actually Reduces Risk

Awareness isn’t about memorizing scams—it’s about behavior.

Protective habits:

-

Never complete transactions on calls

-

Always initiate contact yourself

-

Treat insurance like banking, not sales

That mindset shift matters most.

Who Is Most Targeted in 2026

High-risk groups include:

-

Recent policy buyers

-

Senior citizens

-

People awaiting refunds or claims

-

Multi-policy holders

Scammers target timing, not just profiles.

Conclusion

Insurance scam calls India have evolved from crude threats to polished procedures. Spoofing, partial data, and fake verification flows make them harder to spot—but not impossible to stop. The safest defense is simple: never trust inbound insurance calls, no matter how professional they sound. Initiate verification yourself, and the scam collapses instantly.

In 2026, caution isn’t paranoia—it’s literacy.

FAQs

Are insurance scam calls increasing in India?

Yes, and they’re becoming more sophisticated and believable.

Can caller ID be trusted for insurance calls?

No. Spoofing makes caller ID unreliable.

Do real insurers ever ask for OTPs?

No. OTP or PIN requests are always a red flag.

What’s the safest way to verify an insurance call?

Hang up and call the official number from the insurer’s website or app.

Why do scammers avoid asking for OTPs now?

They want victims to feel in control and bypass suspicion.